maine tax rates for retirees

Your average tax rate is 1198 and your marginal tax rate is 22. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

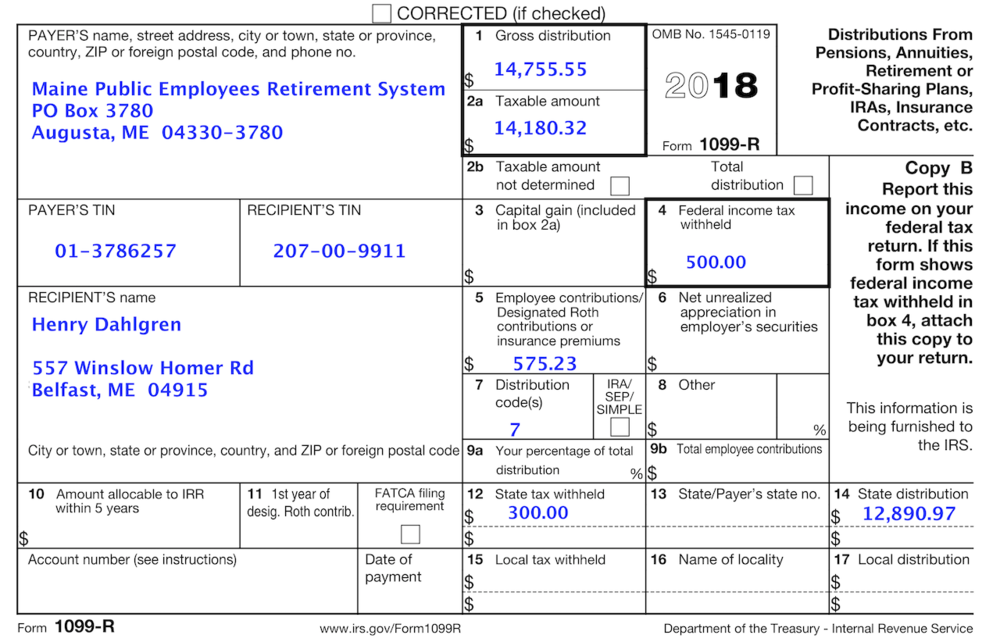

For a retiree this amount is calculated by subtracting.

. The states top rate still ranks as one of the. Maine tax rates for retirees. Maines income tax rate ranges from 58 to a top.

However Maines sales tax rate is considerably low at 55. Maine with a tax burden of just over 10 is the ninth highest in the country. This marginal tax rate.

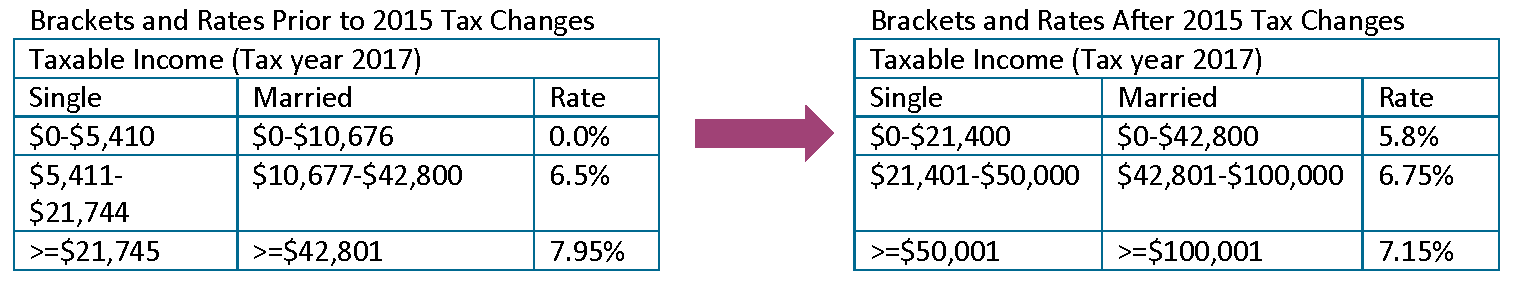

Recipients are responsible for state taxes in the state in which they reside. Maine tax rates for retirees. The rates ranged from 0 to 795 for tax years beginning after.

Permanently exempted groceries from the state sales tax in 2022. Maine with a tax burden of just over 10 is the ninth highest in the country. The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015.

The Maine State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 Maine State Tax CalculatorWe also provide State. Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns. Maine tax rates for retirees.

Property tax exemption for seniors 65 and. For the 2016 tax year the highest tax rate was lowered again to 715 where it has remained through at least the 2021 tax year. Recipients are responsible for state taxes in the state in which they reside.

Marginal Income Tax Rates. If you receive retirement income from a pension IRA or a 401 k then you will be required to pay taxes as high as 715. Maine with a tax burden of just over 10 is the ninth highest in the country.

Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. This is the amount subject to tax by the State you reside in. If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

Pension contribution in box 14 of 4524 to MPERS state wages in box 16 are for. Retiree has not paid Federal or State taxes on the interest their contributions earned while they were working. Payment Vouchers for the 2022 tax year.

The Board of Trustees adopts the CPI-U as of June 30th up to 30 of the base benefit currently 2418625 for State Teacher Legislative and Judicial Retirement Program eligible retirees. For deaths in 2020 the estate tax in maine applies to taxable estates with a value over. Other states provide only partial exemption or credits and some tax all retirement income.

States With The Highest Lowest Tax Rates

Tax Maps And Valuation Listings Maine Revenue Services

State Withholding Tax Table Maintenance Maine W Hx02

The 2015 State Business Tax Climate Index Tax Foundation Of Hawaii

How Maine S Personal Income Taxes Work Mecep

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Gasoline And Diesel Tax Rates In Maine 1997 2010 Statista

Maine Loses People And Their Income To States With No Personal Income Tax Maine Policy Institute

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Property Tax Rates By Town The Master List

Maine State Tax Refund Tax Brackets State Tax Deductions

Maine Township Residents Pay Effective Property Tax Rates Of About 2 Far More Than Neighboring States Wirepoints

Farmington Board Recognizes Richard Davis On His Retirement Sets 2021 Tax Rate Centralmaine Com

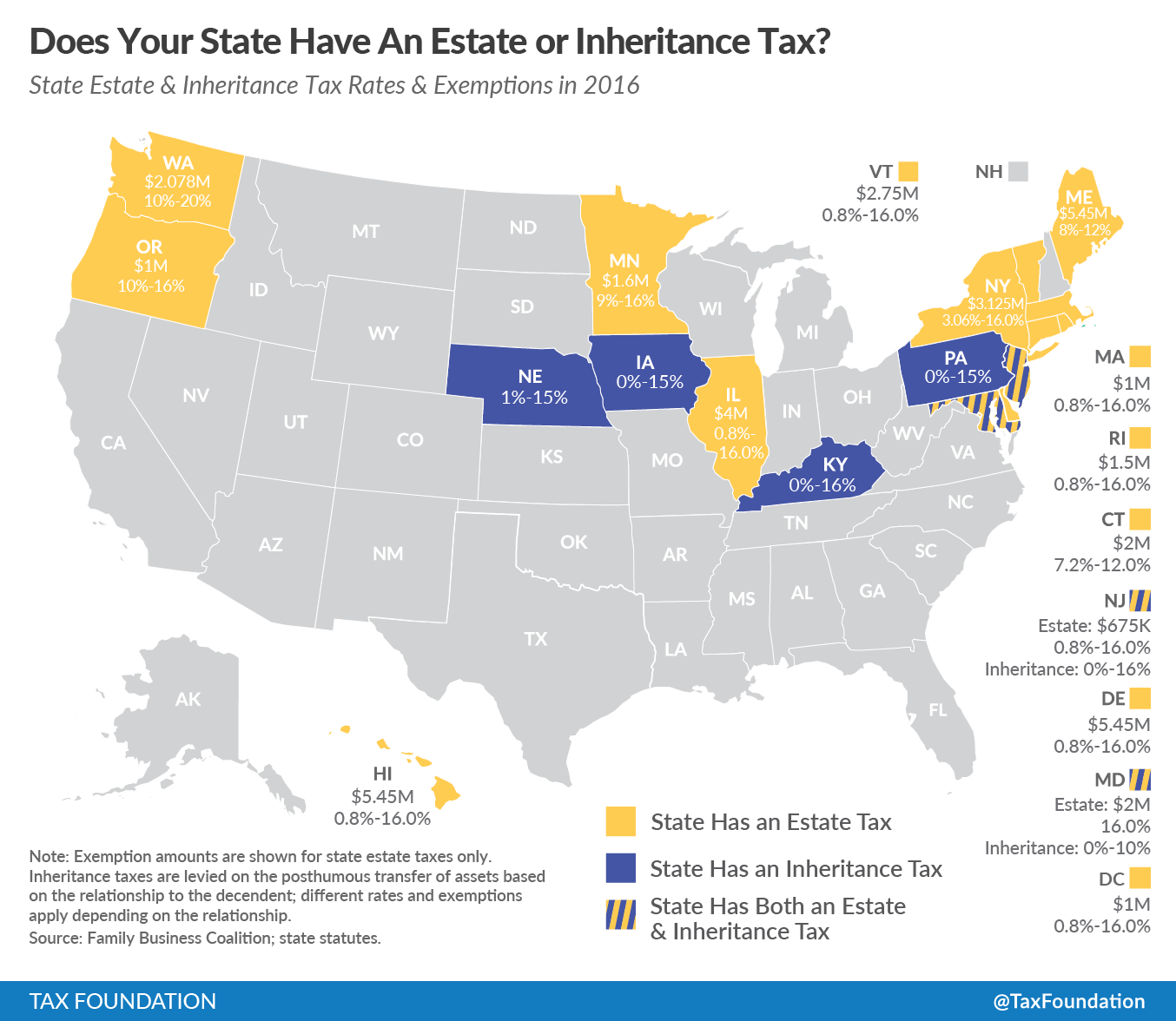

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Maine Governor Lepage Proposes Good Tax Policy In New Budget Tax Foundation